Public investment

There is general agreement that the state must invest in the future. But how exactly? What are the reasons for current problems? How can we do better in the future? The following texts provide an overview on public investment in Germany.

Does Germany need more public investment?

Due to the challenges of digitalisation, demographic change and climate change, the need for public investment is undeniable. Furthermore, to achieve appropriate living conditions in all regions and social cohesion, a working public infrastructure is essential.

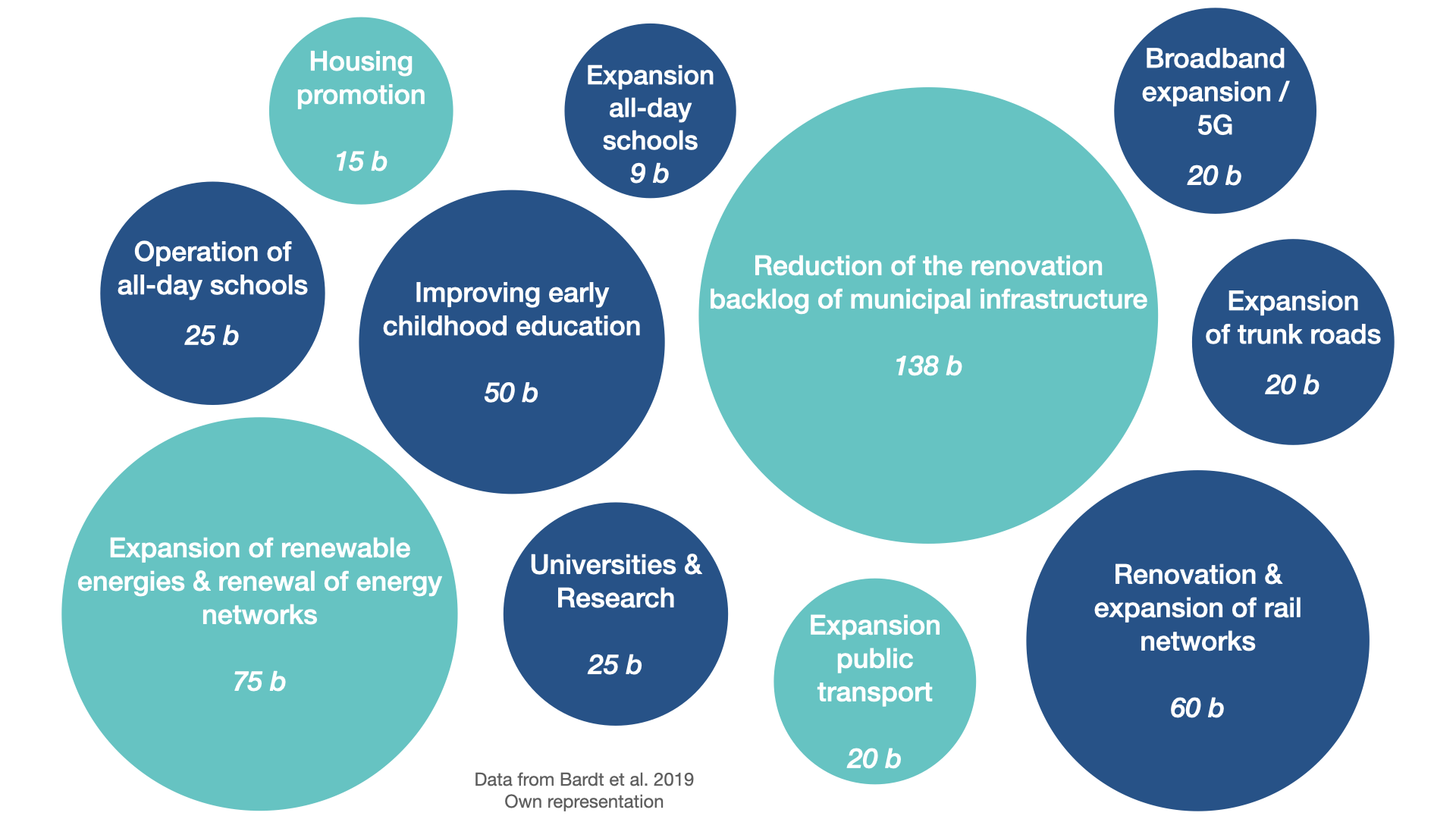

A collaborative paper by the Macroeconomic Policy Institute (IMK) and the German Economic Institute (IW) gives a thorough overview of the current need for additional public investment. The former institute is close to labour unions, while the latter is financed by business associations. This paper estimates the demand for additional public investment in Germany in the next ten years at approximately €450 billion. The different components of the needed investment can be seen here (Bardt et al. 2019).

How does public spending affect private investment?

Governments’ investment also impacts the capital spending of households and businesses. Generally, two main channels describe this impact; the crowding-out effect and the crowding-in effect. From a theoretical standpoint, the result of these two effects is not certain (e.g. Ramey 2020; Leeper et al. 2017; Bachmann & Sims 2011).

However, a recent empirical research study by the German Economic Research Institute (DIW Berlin) finds a statistically significant crowding-in effect since Germany’s reunification. Every Euro invested in public spending led to an additional 1.50€ in private investment (Belitz et al. 2020). Several different papers confirm the predominance of the crowding-in effect (e.g. Dreger & Reimers 2014; Kitlinski 2015; Clemens et al. 2019). Furthermore, it is important to mention that public spending enhances investment in the private sector, especially in periods of low interest rates and economic crises. In the short run, public investment primarily induces additional private investment in the construction and manufacturing sectors. In the long run, it also causes significant investment in research and development (Belitz et al. 2020).

What factors inhibit and limit public investment?

Low political attractiveness: Investments tend to be neglected in day-to-day political life. This is because their benefits only occur in the future. Thus, the effect of postponing investments is only noticed later on (see Bardt et al. 2019).

The dogma of lean government: Since the early 2000s the idea of a lean government has contributed to the political attention on reducing expenditure and fiscal income. Simultaneously, privatisation projects have been pursued and public investments have been neglected (Hüther 2020). This tendency has been exacerbated by low estimates of the need for public investment. These estimates were based on what we now know to have been incorrectly low forecasts of population and economic growth (Bardt et al. 2019).

Insufficient financial resources for local governments: Since the 1990s the share of expenditure by local governments dedicated to investment has diminished. This is particularly relevant because local governments are responsible for 55 % of the German capital stock (Bardt et al. 2019; Fratzscher 2016, Grömling et al. 2019).

Limited planning capacity: The lack of financial resources in local governments has reduced staff and administrative capacity. Thus, planning capacity has diminished strongly. Consequently, planning procedures for investment projects tend to take considerably longer (Truger 2016; Fratzscher 2016).

Bureaucratic constraints: The bureaucratic requirements for public projects have increased considerably in recent decades. Legal rules and lawsuits by local residents and organisations make procedures more complex and require additional planning capacity. Especially in the context of investing in renewable energy, this bureaucracy places tight constraints. (Puls 2020).

Capacity of the construction sector: The construction sector strongly reduced its capacities during a crisis in the 2000s. Thus, current demand cannot be met sufficiently. Expanding capacities in the construction sector takes time and confidence in stable long-term demand (e.g. by the public sector) in order to be profitable. Given the low public investment activity in recent years, this has not been the case (Bardt et al. 2019; Feld et al. 2020; Puls 2020).

Controversy: Some economic analyses explain the built-up of required but unmet public investment not to a lack of financial resources, but primarily to the construction sector’s insufficient capacity and inadequate planning capacity (Feld et al. 2020). Conversely, others attribute the lack of public investment and hesitant capacity expansions of public planning and the construction sector to the low priority granted to public investment and insufficient public resources (Bardt et al. 2019; Truger 2016; Hüther 2020).

What measures facilitate public investment?

Reform of budgetary rules: Is there a need to amend budgetary rules to allow for a sustainable fiscal policy? If yes, how so? We are currently working on a series of short texts on budgetary rules that are due to be published soon.

Financial scope for local governments: Local governments are particularly relevant for public investment. Increasing their financial scope could be effective in leveraging the required investment (Fratzscher, 2016). Remission of debts and additional support for social expenditure could be suitable measures for this purpose and would be particularly beneficial for structurally disadvantaged regions.

Increasing planning capacity: More financial resources would enable the administration to plan their staff capacities more flexibly while also counteracting the lack of qualified staff by creating more attractive employment conditions. Additionally, a public consulting agency could support local governments who exhausted their planning capacities and contribute to a more efficient investment project implementation (Fratzscher, 2016). Such an agency has already been founded under the name of “Partnerschaft Deutschland.” Their services should be expanded.

Federal investment fund: A federal investment fund controlled by the national government could realise investment projects under commission of federal states or local governments and take up loans for this purpose. Federal states and local governments could lease the project against a fee to use it and acquire ownership at a later stage (Bardt et al. 2019; Fratzscher 2016). Thus, constraints in terms of financial resources and staff capacity – particularly in local governments – could be avoided. Also, such an investment fund would not fall under the restrictions of national and European budgetary rules.

Switch of public accounting: Public accounting has been based on the principle of cameralistics for a long time. This accounting system only represents income and expenditure but excludes assets. If the state builds a bridge, cameralistic accounts only reflect the required expenditure. Thus, investment projects lead to fiscal deficits. If instead a double-entry accounting system was used, the bridge would also be accounted for as an additional asset. Given that investment expenditure is simultaneously considered acquisition of assets, there is no net burden on the fiscal budget. This way, even large-scale investment projects are feasible, whereas under cameralistics, major public investments collide with the fiscal scope under budgetary rules. Federal states and local governments have been granted permission to choose between double-entry accounting and cameralistics, but nationwide introduction is not yet intended (Kirchgässner 2014; Sternberg, 2020).

References

Confidence and the Transmission of Government Spending Shocks. Cambridge, MA: In National Bureau of Economic Research. http://doi.org/10.3386/w17063

Die Infrastruktur in Deutschland: Zwischen Standortvorteil und Investitionsbedarf. In IW-Analysen Nr. 95. Institut der deutschen Wirtschaft (IW). Köln. http://hdl.handle.net/10419/181856

Für eine solide Finanzpolitik: Investitionen ermöglichen!. In IMK Report Nr. 152. Institut für Makroökonomie und Konjunkturforschung (IMK). Düsseldorf. http://hdl.handle.net/10419/213410

Öffentliche Investitionen als Triebkraft privatwirtschaftlicher Investitionstätigkeit. In Politikberatung kompakt 158. DIW Berlin. http://hdl.handle.net/10419/233017

Public Investment a Key Prerequisite for Private Sector Activity. In DIW Weekly Report. https://doi.org/10.18723/diw_dwr:2019-31-2

Does public investment stimulate private investment? Evidence for the euro area. Economic Modelling, 58, 154-158. https://doi.org/10.1016/j.econmod.2016.05.028

Öffentliche Investitionen: Die Schuldenbremse ist nicht das Problem. Perspektiven der Wirtschaftspolitik, 20(4), 292-303. https://doi.org/10.1515/pwp-2020-0002

Stärkung von Investitionen in Deutschland. In Stellungnahme der Expertenkommission im Auftrag des Bundesministers für Wirtschaft und Energie, Sigmar Gabriel. Bundesministerium der Wirtschaft und Energie. [Online] https://www.bmwi.de/Redaktion/DE/Downloads/S-T/stellungnahme-expertenkommission-staerkung-von-investitionen-in-deutschland.pdf?__blob=publicationFile&v=4 [Abgerufen am: 25.01.2021]

Verzehrt Deutschland seinen staatlichen Kapitalstock?. In Wirtschafsdienst 99. Seite 25-31. Wirtschaftsdienst. https://doi.org/10.1007/s10273-019-2390-3

How to re-design german fiscal policy rules after the Covid19 pandemic. In IW-Policy Paper 25/20. Institut der Deutschen Wirtschaft. http://hdl.handle.net/10419/228778

Die Schuldenbremse der Bundesländer: Eine Fehlkalkulation. In 94. Jahrgang. S.721-724. Wirtschaftsdienst. https://doi.org/10.1007/s10273-014-1739-x

The robustness of the effects of public investment in infrastructure on private output: Evidence for Germany. In Ruhr Economics Papers 560, RWI – Leibniz-Institut für Wirtschaftsforschung. http://doi.org/10.1007/s10273-014-1739-x

Clearing Up the Fiscal Multiplier Morass. In American Economic Review 107, 8, Pages 2409–2454. https://doi.org/10.1257/aer.20111196

Jenseits des Geldes – Was behindert den Infrastrukturausbau in Deutschland?. In IW Report 37/2020. Institut der Deutschen Wirtschaft. http://hdl.handle.net/10419/223200

The Macroeconomic Consequences of Infrastructure Investment. Cambridge, MA: National Bureau of Economic Research. https://doi.org/10.3386/w27625

Der deutsche Staat kennt seine Bücher nicht. In Makronom. 2020. [Online] https://makronom.de/fiskalpolitik-doppik-kameralistik-der-deutsche-staat-kennt-seine-buecher-nicht-35129 [Abgerufen am: 02.02.2021]

The golden rule of public investment: A necessary and sufficient reform of the EU fiscal framework?. In IMK Working Paper. Nr. 168. Institut für Makroökonomie und Konjunkturforschung (IMK). Düsseldorf. http://hdl.handle.net/10419/144925